News: Markets

3 August 2020

Smartphone shipments fall a record 16% year-on-year in Q2 to 278.4 million

Global smartphone shipments fell 16% year-on-year to 278.4 million in second-quarter 2020, according to preliminary data from the International Data Corp (IDC) Worldwide Quarterly Mobile Phone Tracker. Although this a larger decline than in first-quarter 2020, it was expected, as major economies around the globe were in lockdown for the majority of Q2 due to the pandemic.

“Smartphones shipments suffered a huge decline in Q2 as they directly correlate to consumer spending, which had a massive reduction due to the global economic crisis and rising unemployment brought on by the widespread lockdowns,” says Nabila Popal, research director with IDC’s Worldwide Mobile Device Trackers. “This, combined with the closure of retail stores, especially in regions where online shopping is less common, compounded the negative effect on smartphone sales. In addition, consumers spent significantly on other technologies, such as PCs, monitors and tablets, to facilitate mandatory work from home and distance learning, leaving an even smaller share in the shrinking consumer wallet for smartphones.”

From a regional perspective, Asia/Pacific (excluding China and Japan), Western Europe and the USA declined 31.9%, 14.8% and 12.6%, respectively. China fared slightly better, with a decline of 10.3%, and arguably shows some early signs of market recovery. “The smartphone supply chain ground to a halt when the pandemic hit. However recovery, specifically in China, has been strong,” notes Ryan Reith, vice president, Worldwide Mobile Device Trackers. “The question now becomes what does demand look like with so much uncertainty around the world. We have already seen OEMs moving more aggressively with their 5G portfolios both in terms of production and price points. However, we still see consumer demand for 5G being low, so the supply-side push is likely to produce very high-priced competition.”

Smartphone company highlights

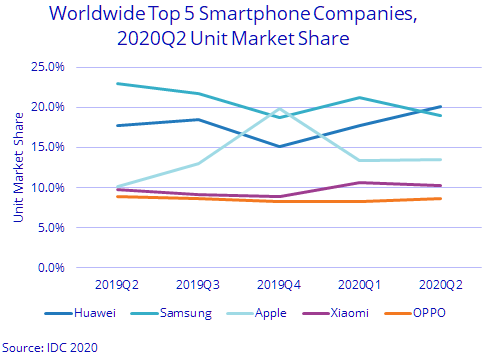

Huawei for the first time reached the number 1 position, with 55.8 million smartphones shipped in Q2, despite a small decline of 5.1% year-on-year. With the overall market declining even faster, the firm also achieved its highest-ever share (20%) of the global smartphone market. This was driven by Huawei's tremendous growth in China – almost 10% year on year – which offset the large declines that it faced in every other region. Looking forward, the impact of the US technology ban will continue to create uncertainty for Huawei in foreign markets.

Samsung shipped 54.2 million smartphones, finishing a close second with 19.5% share. However, the South Korean firm suffered a 28.9% year-on-year decline, the most significant among the top five vendors. While the A series continues to perform well, contributing to the majority of its volume, premium devices such as the Galaxy S20 and the Galaxy Z Flip, unfortunately launched in the peak of the pandemic, are facing sales challenges despite price reductions.

Apple shipped 37.6 million iPhones, which placed it in third with 13.5% share of the market. iPhone shipments managed to climb 11.2% year-on-year due to the continued success of the iPhone 11 series and the timely launch of the new SE (2020), which managed to effectively target the lower-priced segment (boding well for the vendor in this time of crisis where consumers are shifting towards more budget-friendly devices). Looking ahead, the launch of four new potential models will signal Apple's entry into 5G and challenge Android 5G devices that have been out for more than a year.

Xiaomi shipped 28.5 million devices, maintaining its number-four position and achieving a 10.2% market share despite shipments falling 11.8% year-on-year. Although Xiaomi faced a large drop in both China and India, the lockdown and anti-China sentiment in India had a larger impact on the vendor, with a 50% year-on-year drop despite maintaining its number one position.

OPPO returned to the top 5 in Q2, with 8.6% market share, despite shipments falling 18.8% year-on-y

ear to 24 million units. Roughly 60% of shipments were to its domestic market of China, which was a key factor in getting the vendor back into the top 5 globally. In China, the A series was again the volume driver while the new Reno 4 series performed much better than expected due to very competitive pricing. Meanwhile, in OPPO’s second-largest market India, the vendor faced challenges in both supply and demand, with factory shutdowns and consumers facing the anti-China sentiment.COVID-19 drives smartphone market’s largest year-on-year quarterly revenue drop, to 275.8 million