News: Markets

23 July 2020

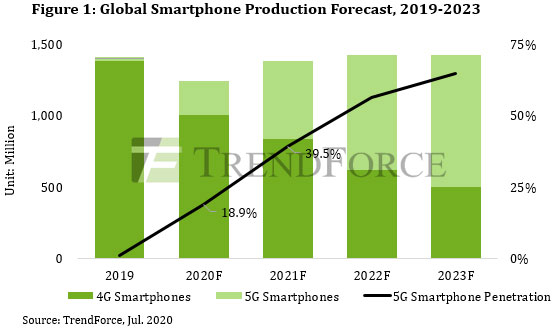

5G handsets to comprise 18.9% of smartphone production in 2020

5G remains a hot topic in the smartphone market this year, as smartphone brands and mobile processor manufacturers, such as Qualcomm and MediaTek, strive to expand their shares in the 5G market. According to market research firm TrendForce, the Chinese government’s 5G commercialization efforts have been particularly aggressive, leading the country’s 5G base-station deployment and network coverage to each score first place in the global 5G industry. As such, Chinese brands, which were ahead of their competitors in 5G strategies, took a 75% share of the global 5G smartphone market in first-half 2020.

Aside from the various Android-based smartphone brands, Apple’s new models will also join the ranks of 5G smartphones. Given the total smartphone production forecast of 1.24 billion units in 2020, 5G handset production will reach 235 million units, an 18.9% penetration rate, reckons TrendForce.

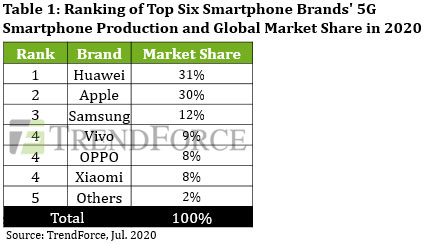

Chinese brands to occupy four of top six 5G smartphone brands by production volume

Analysis of the projected top six smartphone brands ranked by 5G smartphone production volume shows Huawei firmly in first place. Under the impact of US sanctions and in preparation for China’s active 5G commercialization efforts, Huawei has shifted its focus to the domestic Chinese market. The firm is expected to produce about 74 million 5G smartphones this year.

Apple’s annual 5G smartphone production is expected to total about 70 million units in 2020, taking second place. However, 5G functions will increase the production cost of smartphones accordingly. If Apple decides to directly reflect this added cost on the retail prices of the iPhone 12 series, it may lower consumers’ willingness to purchase, in turn affecting the sales performances of the new iPhones, reckons TrendForce.

Samsung has been experiencing setbacks in the Chinese market in recent years. Although these have not seriously affected its global market share and revenue, they have considerably slowed Samsung’s growth in the 5G smartphone market. Its 5G smartphone production this year is forecasted to be 29 million units, placing it third globally.

Vivo, OPPO (including OnePlus, OPPO, and Realme) and Xiaomi are tied for fourth place. As Huawei’s aggressive domestic expansion in the past few years has compressed the market shares of the three brands in the Chinese market, they have been actively focusing on increasing overseas market shares to maintain their annual production performances. Vivo, OPPO and Xiaomi’s annual 5G smartphone production volumes are projected to reach about 21 million, 20 million and 19 million units, respectively.

Mid-to-low-end 5G chipsets from AP suppliers to boost 5G smartphone penetration in 2021

An aggressive push by mobile processor manufacturers will lead to the rapidly increasing presence of 5G chipsets in the mid-to-low end market, driving 5G smartphone production above 500 million units in 2021, potentially to about 40% of the total smartphone market, reckons TrendForce.

Once 5G chip prices reach a stable level this year, smartphone brands may look to gain additional shares in the 5G market by sacrificing gross margins. In doing so, they are likely to accelerate the drop of 5G smartphones’ retail prices, and the market may see the arrival of 5G smartphones around the RMB1000 price level by the end of this year.

Incidentally, the penetration rate of 5G smartphones does not equal the usage rate of the 5G network, which depends on the progress of base-station construction. Since the current 5G infrastructure build-out is pushed back as a result of the pandemic, global 5G network coverage is unlikely to surpass 50% before 2025 at the earliest, with complete coverage taking even longer, notes TrendForce.

Smartphone production falls 10% year-on-year in Q1 and to fall a record 16.5% in Q2