News: Markets

30 June 2020

Mini-LED supply chain to benefit from Q1/21 release of Apple’s 12.9-inch iPad Pro

As Apple’s upcoming release of products featuring mini-LED backlighting is generating growth in mini-LED demand, the firm has also stimulated players in the mini-LED supply chain to increase their production capacities. According to the LEDinside research division of TrendForce, in first-quarter 2021 Apple is expected to not only release its 12.9-inch, mini-LED backlight-equipped iPad Pro but also open contract bids for its 14-inch and 16-inch MacBooks.

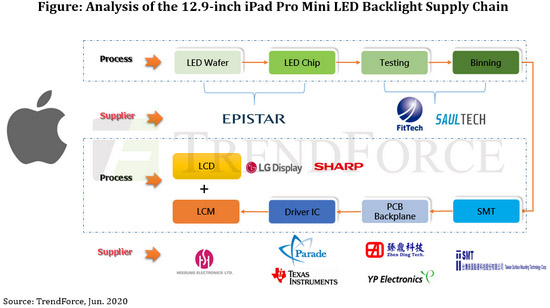

Apple has currently chosen Taiwanese manufacturers of display-related components to supply its mini-LED backlights, since Taiwanese suppliers are said to have an advantage in new product development, given their product stability and technological maturity. Both upstream and downstream suppliers are expected to participate in the mini-LED supply chain, including LED chip maker Epistar, testing & sorting OEM FitTech, pick & place and die attach solutions provider Saultech, SMT supplier TSMT, and PCB backplane manufacturer Zhen Ding Tech – all of which serve important roles in the development of new mini-LED backlight displays.

Mini-LED backlight displays have high brightness and high contrast ratios, which can exceed 1,000,000:1, compared with the 10,000:1 of existing mainstream displays. Furthermore, mini-LED displays are also highly reliable, as they can maintain proper functioning and deliver consistent brightness in harsh environments with temperatures ranging between +60°C to -10°C.

All of these strengths make mini-LED technology especially attractive to branded manufacturers. As such, Apple has incorporated mini-LED backlights as one of its core areas of focus in its future planning of new display products.

Although Chinese manufacturers currently possess enormous production capacity and cost advantages in the upstream and downstream LED supply chain, Apple has instead chosen to collaborate with Taiwanese manufacturers (which form a more stable supply chain) in an effort to avoid the impacts from the China-US trade war. In addition, Taiwan invested in LED R&D significantly earlier than China did, meaning it leads the latter in terms of both technological maturity and patents. These advantages, combined with the ease of procuring raw materials and components, make Taiwanese suppliers more efficient in the development of new technologies, says TrendForce.

Apple’s 12.9-inch iPad Pro to spur wave of demand in LED supply chain

Apple’s 12.9-inch iPad Pro is expected to feature 10,384 mini-LED chips and achieve high contrast ratio and high color saturation through local dimming; as such, the biggest challenge facing manufacturers in the supply chain remains the demand for low cost and high yield rate, according to TrendForce. From the perspective of LED chips, Epistar remains Apple’s first choice because of its products’ consistency and cost-performance ratio, as well as its protection of patents. Also, mini LED backlight technology requires an extremely stringent testing and sorting process for LED chips based on wavelength and specifications; FitTech and Saultech are thus able to become key partners for Epistar due to their cost-to-performance advantage as well.

On the other hand, SMT supplier TSMT is in partnership with Kulicke and Soffa Industries Inc (K&S), as specified by Apple, to attempt to overcome mass-production bottlenecks through their specific high-speed SMT process. For PCB backplanes, Apple has chosen to collaborate with Korean manufacturer YP Electronics and Taiwan-based Zhen Ding Tech, a subsidiary of longtime Apple ODM Hon Hai Precision Industry (better known as Foxconn). Finally, Apple has partnered with Heesung Electronics and LG Display, both Korean manufacturers, to supply its backlight modules and panels. With the release of Apple’s new models, more suppliers, such as GIS, Radiant, Sharp and BOE, are expected to become part of Apple’s supply chain, says TrendForce.