News: Suppliers

1 May 2020

Aixtron’s Q1 revenue falls 40% year-on-year to €41m

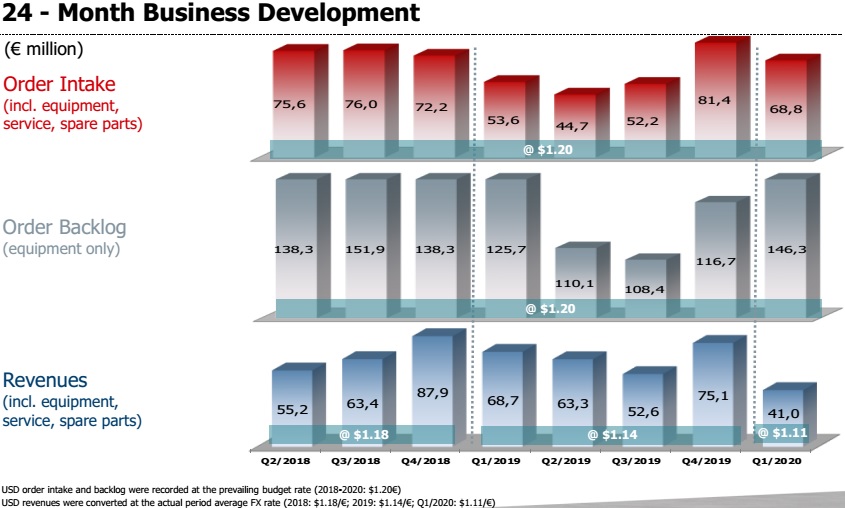

For first-quarter 2020, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €41m, down 45% on €75.1m last quarter and 40% on €68.7m a year ago, due mainly to the low order intake last summer (Q2 and Q3/2019).

Revenue was only slightly below expected due to the delivery of a few systems to China being postponed to Q2/2020 at the request of customers as a result of restrictions related to the COVID-19 coronavirus pandemic. Also, some systems, especially in China, could not be commissioned (in terms of final acceptances) in Q1/2020 as planned. “Overall, however, revenues were in line with planning for the year as a whole,” president Dr Felix Grawert. “Despite the special global situation, we remain fully operational and able to meet our customer demand,” he adds.

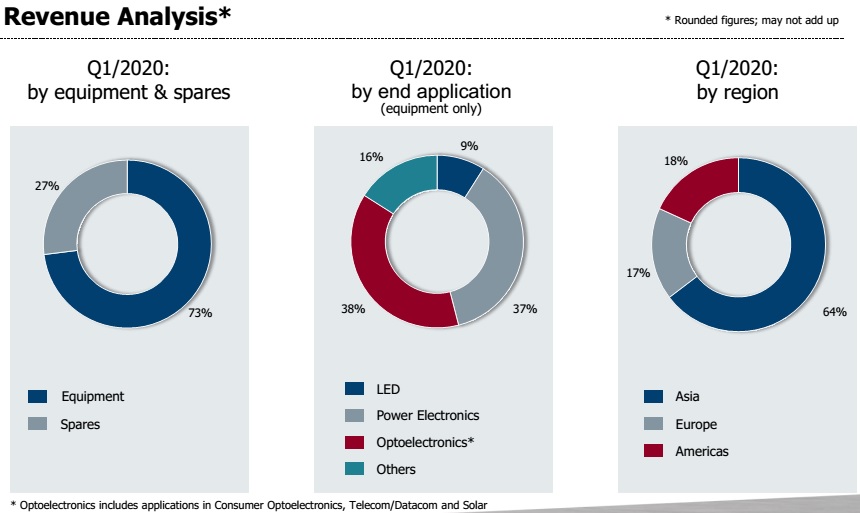

Equipment revenue shrank by 47% year-on-year from €56.1m a year ago to €29.9m (falling from 82% to 73% of total revenue). Revenue from spare parts & services fell by 12% from €12.5m to €11m (although rising from 18% to 27% of total revenue).

Of equipment revenue, the proportion from metal-organic chemical vapor deposition (MOCVD) systems for producing LEDs – including red-orange-yellow (ROY) and specialty LEDs – comprised just 9% of total revenue (down from 56% a year ago). Systems for manufacturing optoelectronic components (i.e. lasers and solar, excluding LEDs) comprised 38% (up from 30% a year ago). Revenue from systems for manufacturing power electronics rose from just 9% to 37%.

Correspondingly, Asian revenue shrank by 54% from €56.7m to €26.3m (falling from 83% of total revenue to 64%), while the Americas grew by 15% from €6.5m to €7.5m (rising from 9% to 18% of total revenue) and Europe grew by 31% from €5.4m to €7.1m (rising from 8% to 17% of total revenue).

Gross margin was 36%, down from 45% last quarter and 39% a year ago, including a 5% impact from under-utilization (of both production capacity and installation personnel) due particularly to the delayed system commissioning in China.

Mainly as a result of the low sales levels and lower gross margin, the operating result (EBIT) was -€1.1m (3% of revenue), compared with +€14.4m (19% of revenue) last quarter and +€9.7m (14% of revenue) a year ago.

“The low order intake in the summer of last year resulted in low revenues and correspondingly low earnings in Q1/2020,” says Aixtron.

Operating cash flow was €4.7m. Capital expenditure (CapEx) has been cut further, to €1.5m. Free cash flow was hence €3m. This was due mainly to customer prepayments (deposits) received rising from €51m last quarter to €60m (reflecting strong order intake), offset partially by a decrease in trade payables from €19.4m to €15.9m and a further increase in inventories from €79m to €85m (including about €12m of prototype systems), both on-site at customers and in Aixtron’s facilities. Trade receivables were €17.1m, representing 30 days sales outstanding (level with the end of last quarter).

During the quarter, cash and cash equivalents including short-term financial investments (bank deposits with a maturity of at least three months) hence rose from €298.3m to €300.8m, due to increased advance payments from customers and the settlement of receivables.

Order intake was €68.8m, down 15% from the exceptionally strong €81.4m last quarter but up 28% on €53.6m a year ago despite the global effects of the COVID-19 pandemic. This was due to continued strong demand in almost all business areas, especially for the increasing use of LED-based display applications, for the production of lasers for optical data transmission and 3D sensor technology (especially in mobile phones). The ongoing expansion of the 5G network and the increasing use of energy-efficient power electronics also continue to generate demand. RF & power electronics comprised 40% of total order intake: about 20% for gallium nitride (GaN) and 20% for silicon carbide (SiC).

Equipment order backlog at the end of March was €146.3m, up 16% on €125.7m a year ago and 25% on €116.7m last quarter.

“From today’s perspective, the COVID-19 pandemic has no significant impact on our business,” says president Dr Bernd Schulte. “We should be able to make up for the delay in some deliveries to China in the first quarter and the postponement of installations mainly in China in the course of the year,” he adds. “In some countries with strict lockdown orders by government, we have obtained the status of critical infrastructure suppliers with the help of our customers, and therefore all our branches worldwide are fully operational,” notes Grawert. “Therefore, in light of the current order backlog and market development, the executive board confirms its guidance for fiscal year 2020.”

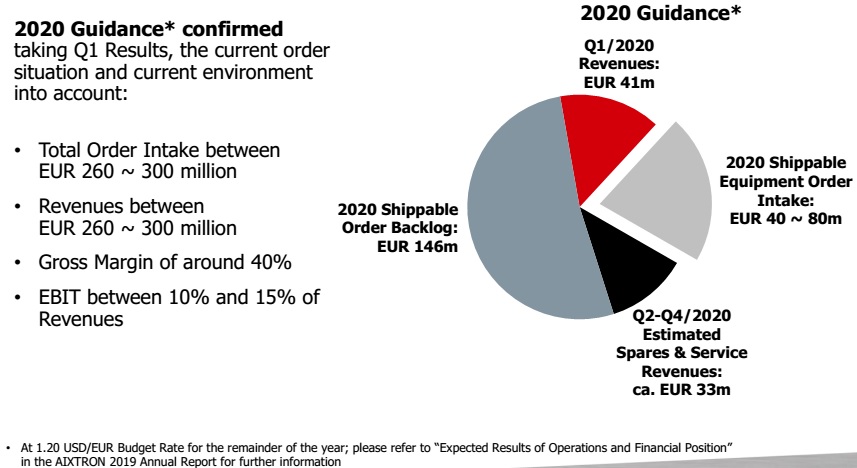

Based on its existing corporate structure, the assessment of the order situation and the budget exchange rate of $1.20/€, Aixtron expects order intake for full-year 2020 to grow to €260-300m (up from €231.9m in 2019).

Based on the equipment order backlog of €146.3m at the end of Q1, joined by an estimated €40-80m of order intake shippable during 2020 plus an estimated €33m of spares & services revenue, for 2020 Aixtron expects revenue of €260-300m. Gross margin should be about 40% and EBIT margin should be 10-15% of revenue.

Regarding organic light-emitting diode (OLED) applications, Aixtron says that its South Korea-based subsidiary APEVA is making good technical progress with the qualification process at its Korean customer. “Some technical challenges have been solved. Other topics are still a work in progress,” says Grawert. “The end of the Gen-2 project and, with this, a decision about a follow-on project, has come closer. But we are not there yet, and a few months of work are still ahead of us,” he adds.

“In our MOCVD business, we are seeing solid interest around our mini- and micro-LED solutions, both for large display applications and for small wearable devices like watches. Furthermore, in optoelectronics, we see growing demand for lasers, in particular for telecom applications. In power electronics, we see strong interest from multiple market segments, gallium nitride power, gallium nitride RF, and silicon carbide, which gives us confidence that this market is moving from R&D to large-scale volume production,” Grawert adds.

“Despite the pandemic, we continue implementing our strategy, a core part of which involves the renewal of our entire MOCVD product portfolio over the next 18 months,” says Schulte. “We do see continued customer interest in our products to further build out critical communications infrastructure, contactless sensing, energy efficient power electronics, and innovative displays. Technically, our focused investments into next-generation deposition tools for compound semiconductors and OLEDs will open new market opportunities for our equipment,” he believes.

“We are working closely with our supply chain to ensure uninterrupted inflow of materials for the ongoing production of our products,” says Grawert. “As part of these activities, we have pre-ordered materials for anticipated production capacities in the second half of this year,” he adds. “We continue to serve customers with spare parts worldwide, and we have created backup solutions for critical cases.”

Aixtron says that its executive board will continuously monitor the impact of the COVID-19 pandemic on the global economy and the movement of goods, in order to assess and - if necessary - take corrective action in the event of any potential impact on the firm’s own supply chain, production, and customer demand.

Aixtron year-to-date revenue grows despite export license delays hitting Q3

Aixtron presents next-gen AIX G5 WW C SiC epi production system