News: LEDs

12 April 2021

Over $5bn spent on micro-LED development

As of first-quarter 2021, more than $5bn has already been spent on micro-LED development,” estimates Yole Développement in its report ‘MicroLED Displays – Intellectual Property Landscape and Analysis 2021’. Of this, 26% has been spent in Apple internal R&D, 37% in other companies’ internal R&D and investments, 24% in investments in startups, and 13% in acquisitions. “Activity is strongly dominated by Chinese companies, followed by Korea,” Eric Virey, principal analyst, Technology & Market, Displays. “LG and Samsung made strong showings in 2019 and kept up the pace in 2020 in terms of new applications,” he adds.

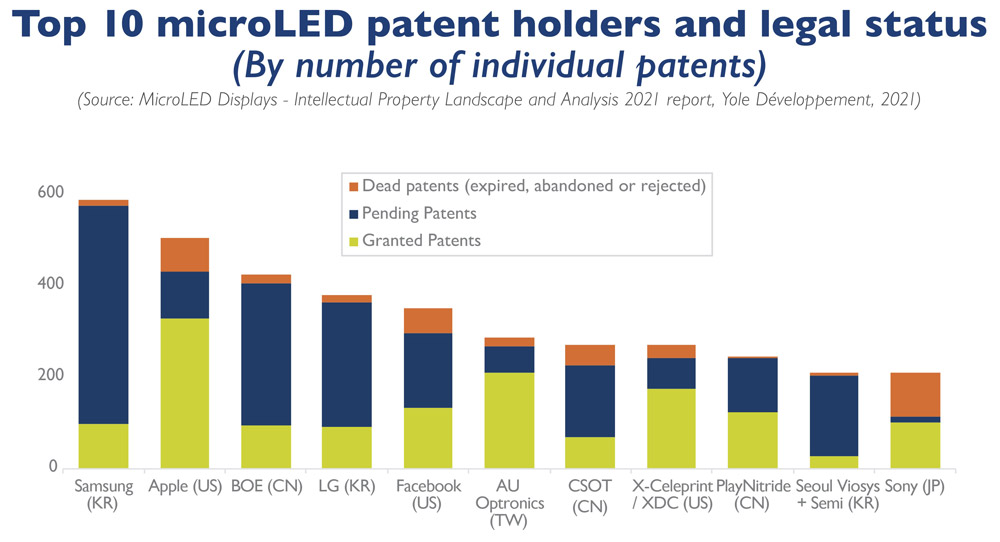

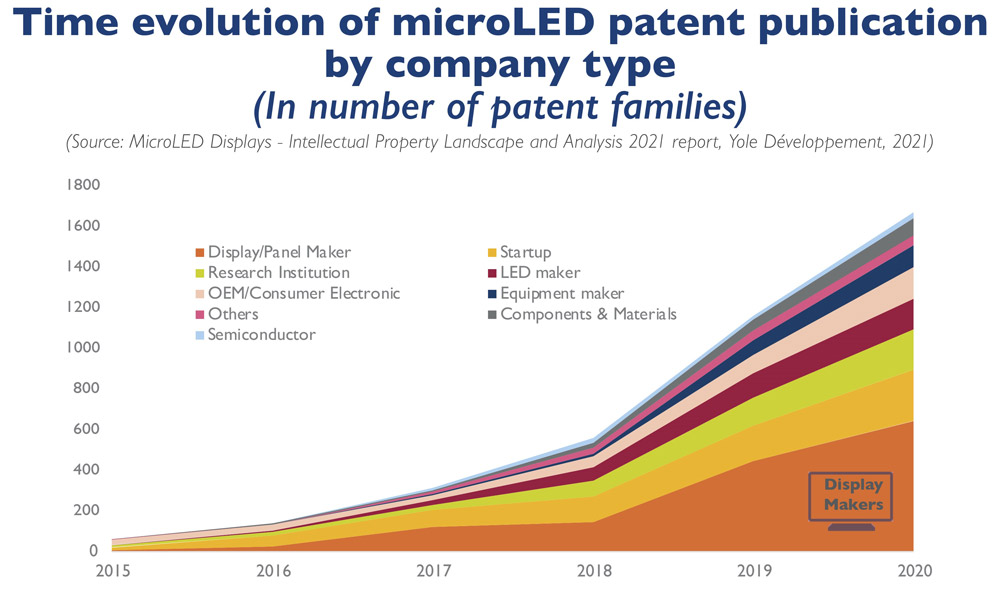

Yole says that 8900+ patents filed by nearly 480 organizations now represent a cumulated total of 4093 families selected for the corpus of patents in the study. Of these 4093 patent families, 40% (1637) were published in 2020 alone (and 81% over the last three years). As of January 2020, just 35% of the published patent applications have been granted, while 53% are still pending. In particular, BOE, LG and Samsung have vast numbers of pending applications, and CSOT is not far behind.

Samsung made a remarkable push with more than 130 new patent families, revolving for mostly around its Display division’s self-assembled nanorod LED technology, often referred to as QNED (Quantum Nano-Emitting Diode). The patents show the technology maturing, and a commitment to tackle the challenges associated with moving QNED from the lab to the fab.

CSOT and BOE led patenting activity in 2019 and remained close to the top in 2020. With similar levels, startup PlayNitride (which raised another $50m in 2020 to expand capacity) is very active, challenging the leading panel makers and original equipment manufacturers (OEMs) like Facebook. Aledia, which moved into a new R&D facility in 2019 and raised nearly $95m in 2020 to build a fab, is also accelerating its IP effort, inching closer to historical leaders such as XDisplay. Panel makers that were absent (such as Japan Display, CEC Panda, HKC and Sakai Display) have now entered the patent corpus.

“The field is getting crowded, but there is still time for ambitious newcomers to build credible portfolios,” says Virey. “In late 2019 and early 2020, Konka and Visionox announced plans to invest $365m and $175m respectively in mini- and micro-LED development and production ramp ups. Konka only filed its first micro-LED patent in 2019 and Visionox in 2017, but both already have sizable portfolios of pending applications, some showing a surprising level of maturity.”

Patent activity at Apple peaked in 2017. However, the quality and details of new applications shows how far the company’s technology has advanced. The acquisition of Tesoro indicates a shift or expansion toward enabling volume production rather than fundamental technology development. Notable, foundry Taiwan Semiconductor Manufacturing Co (TSMC), which is expected to be one of Apple’s key partners, appears for the first time in Yole’s corpus.

Yole concludes that commercialization of the first micro-LED displays is just around the corner, with Vuzix’s new augmented reality (AR) glasses featuring micro-LED micro-displays from JB Display, and Samsung’s modular 110”, 99” and 88” TVs using chips from PlayNitride.