News: Markets

5 January 2021

Smartphone production falls a record 11% to 1.25bn units in 2020 as Huawei exits top-six ranking

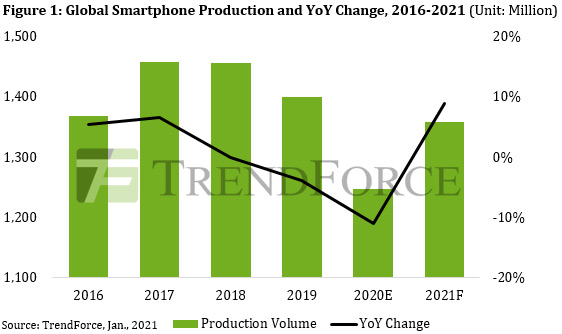

Due to the impact of the COVID-19 pandemic, global smartphone production fell by record 11% year-on-year (YoY) in 2020 to just 1.25 billion units, according to market research firm TrendForce.

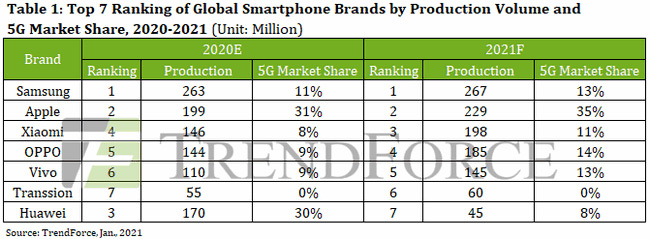

The top six smartphone brands ranked by production volume for 2020, in descending order, are Samsung, Apple, Huawei, Xiaomi, OPPO and Vivo. The most glaring change from the previous year is Huawei’s market share.

Honor will formally separate from Huawei and operate as an independent smartphone maker at the start of 2021, notes TrendForce. The aim behind this spin-off is to ensure the survival of Honor, which has become a major brand in the global smartphone market after years of labor. However, it remains to be seen whether the ‘new’ Honor can capture consumers’ attention without the support from Huawei. Also, Huawei and the new Honor will be directly competing against each other in the future, especially if the former is somehow freed from the US trade sanctions at a later time. With the new Honor seeking to ramp up production, Huawei will have more difficulty in regaining market share for smartphones, believes TrendForce.

Looking ahead to the rest of 2021, TrendForce forecasts that the global smartphone market will gradually recover as people become accustomed to the ‘new normal’ resulting from the pandemic. Moreover, this year will likely see a relatively strong wave of device replacement demand as well as demand growth in the emerging markets. Assuming that these conditions will materialize, annual global smartphone production for 2021 is forecasted to rise by 9% to 1.36 billion units.

Regarding the annual global ranking of smartphone brands for 2021, Huawei will see a further and significant decline in its device production due to the effects of the US export restrictions and the spin-off of Honor as a separate entity operating in the smartphone market, expects TrendForce. Huawei is projected to tumble from third place in 2020 to seventh place in 2021. The top six for 2021, in descending order, will be Samsung, Apple, Xiaomi, OPPO, Vivo and Transsion, collectively accounting for almost 80% of the global smartphone market.

Nevertheless, the pandemic will remain the central variable (or the biggest uncertainty) in the production projection because it will continue to exert significant influence on the global economy. Besides the pandemic, the performance of smartphone brands during 2021 could also be affected by geopolitical instabilities and the lack of available production capacity in the semiconductor foundry market.

Penetration of 5G smartphones to reach 37% in 2021, constrained by foundry capacity

Due to the Chinese government’s aggressive push for 5G commercialization in 2020, global 5G smartphone production for the year rose to about 240 million units, a 19% penetration rate, with Chinese brands accounting for almost 60% market share. While 5G will remain a major topic in the smartphone market this year, various countries will also resume their 5G infrastructure build-out, and mobile processor manufacturers will continue to release entry-level and mid-range 5G chips. As such, the penetration rate of 5G smartphones is expected to rise rapidly to 37% in 2021, for annual production of about 500 million units.

Under the optimistic assumption that the pandemic can be resolved within the year, shipments for various end-products (including servers, smartphones and notebook computers) will grow year-on-year compared with 2020, notes TrendForce. In particular, the number of power management integrated circuits (PMICs) and CMOS image sensors (CIS) contained per handset will each double in order to meet increased smartphone specifications. On the other hand, major Chinese foundry Semiconductor Manufacturing International Corp (SMIC) has recently been added to the US Department of Commerce’s Entity List once again. This is expected to exacerbate the foundry industry’s already-strained production capacity.

The recent bullish outlook of Smartphone brands towards the 2021 market and their attempt to secure more semiconductor supplies by increasing their smartphone production targets can potentially lead these brands to overbook certain components at foundries, notes TrendForce. However, smartphone brands may adjust their component inventories from Q2/2021 to Q3/2021 and reduce their semiconductor procurement activities if actual sales performances fall short of expectations, or if component bottlenecks remain unresolved, leading to a widening inventory gap between bottlenecked and non-bottlenecked parts. Even so, TrendForce still forecasts an above-90% capacity utilization rate for foundries in 2021.

Smartphone production falls a record 16.7% year-on-year in Q2

5G handsets to comprise 18.9% of smartphone production in 2020