News: Markets

26 July 2021

Optical transceiver market growing at 14% CAGR to $20.9bn in 2026

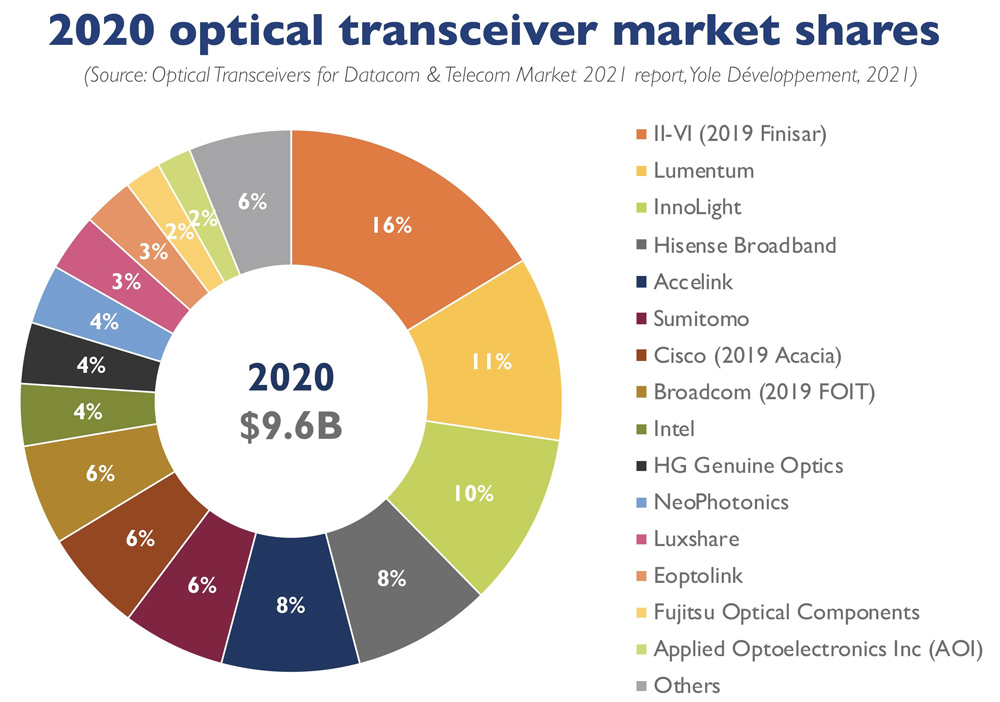

The optical transceiver market was $9.6bn in 2020 and is rising at a compound annual growth rate (CAGR) of 14% to $20.9bn in 2026, driven by high-volume adoption of high-data-rate modules (above 100G) by big cloud service operators and national telecom operators in order to increase fiber-optic network capacity, forecasts Yole Développement in its report ‘Optical Transceivers for Datacom & Telecom Market 2021’. The COVID-19 pandemic has affected optics manufacturing globally. However, in the last three years the optical transceiver industry has still grown by 24% in China but only 1% in the USA.

“For the past 50 years, mobile technology innovations have been rolled out each decade,” notes Martin Vallo PhD, technology & market analyst, Solid-State Lighting. “Mobile bandwidth requirements have evolved from voice calls and texting to UHD [ultra-high-definition] video and a variety of AR/VR [augmented reality/virtual reality] applications,” he adds. “In spite of deep implications of the COVID-19 outbreak for the telecom infrastructure supply chain, consumers and business users worldwide continue to create new demand for networking and cloud services. Social networking, business meetings, video streaming in UHD, e-commerce and gaming will drive the continued application growth”.

The average number of devices connected to the Internet per household and per capita is increasingand, with the advent of new digital devices with increased capabilities and intelligence, adoption rates are rising each year, notes the report. Expanding machine-to-machine applications, such as smart meters, video surveillance, healthcare monitoring, connected drives and automated logistics contribute in a major way to device and connection growth and push the expansion of data-center infrastructure.

The evolution of multiple technologies has enabled data rates of 400G, 600G, 800G and beyond across data-center infrastructure as well as in long-haul and metro networks. While 400GbE deployments are ramping across data-center networks, many cloud providers and telecom operators are now looking to the 800Gbps optical ecosystem to increase bandwidth capacity and keep pace with the growing demand for data: 800G optical modules can support more configurations, for example 2x 400GbE, 4x 200GbE or 8x 100GbE.

Today’s Ethernet switch application-specific integrated circuits (ASICs) are running at a 50Gbps lane rate driven by 50G PAM-4 (4-level pulse amplitude modulation) technology. In line cards, a re-timer is typically needed to synchronize PAM-4 data from the switch to the optical interface. In 400G optical modules, an additional silicon gearbox chip can be used to convert 50G PAM-4 electrical inputs/outputs (I/Os) to 100G per wavelength optical I/Os in order to connect to 100G optics. Depending on the application and transmission reach, 400G offers various optical interfaces, including 400G SR4, 400G DR4, 400G FR4 and 400G LR4.

“We anticipate high popularity of 800G modules as they take advantage of 100G single-wavelength optics already proven in 400GbE systems and thus can be technically and cost-effectively implemented in QSFP-DD [Quad Small-Form-factor Pluggable Double-Density] and OSFP [Octal Small-Form-factor Pluggable] form factors,” says Pars Mukish, business unit manager, Solid-State Lighting & Display.

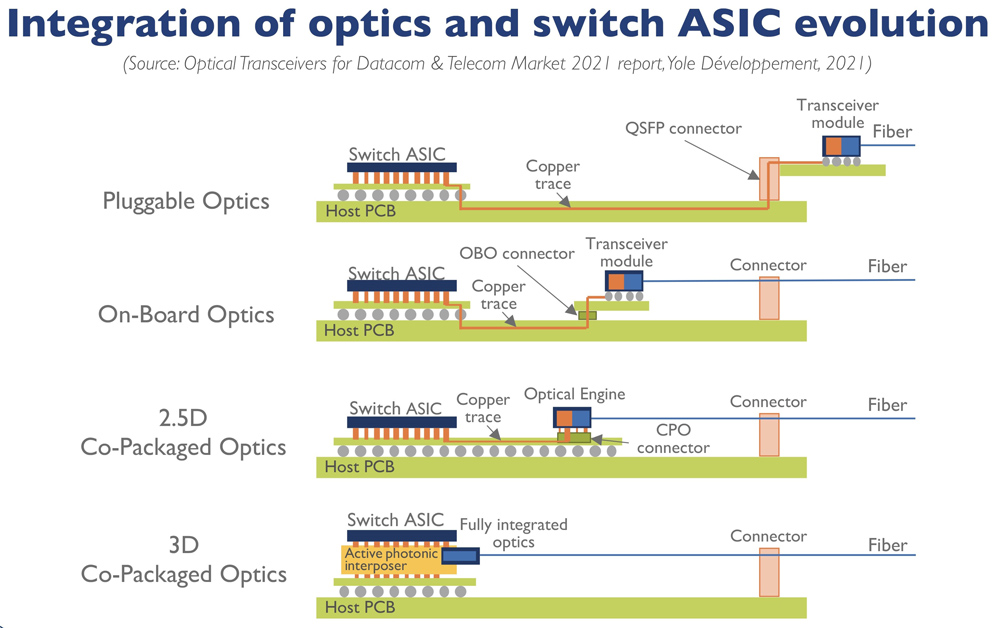

Existing form factors will be limited in their ability to support more than 800G capacity in terms of the required electrical and optical densities and thermal aspects, notes the report. Power consumption is another challenge. The largest contributor is the electrical interface between the switch ASIC and optical module, particularly for QSFP-DD and OSFP. As a result of discrete electrical device implementation, power dissipation and thermal management are becoming limiting factors for future pluggable optics, states Yole.

In this regard, Yole’s partner, the reverse engineering and costing company System Plus Consulting, provides insight into the technology data, manufacturing cost and selling price of InnoLight’s TDP4CNT-N00 400Gb QSFP-DD optical transceiver in its ‘InnoLight’s 400G QSFP-DD Optical Transceiver’ analysis. “InnoLight’s 400G QSFP-DD is one of the first 400G optical transceivers on the market allowing communication up to 2km using PSM4 modulation,” notes Sylvain Hallereau, principal technology & cost analyst at System Plus Consulting. “The InnoLight solution is based on the IN010C50 PAM4 DSP [digital signal processor] chipset, four gallium arsenide (GaAs) laser driver dies, and a TIA [transimpedance amplifier] die, all designed by Inphi”.

Also, aiming to overcome the challenges mentioned above, co-packaged optics (CPO) is a new approach that brings the optics and the switch ASIC close together. Furthermore, CPO technology is considered as a new deployment model of the whole ecosystem and alternative to pluggable optics.

www.i-micronews.com/products/optical-transceivers-for-datacom-telecom-market-2021