News: Markets

1 October 2021

GaN power device market to grow 73% to $83m in 2021

Demand for fast chargers used for various consumer electronics applications has been rising quickly, notes market research firm TrendForce. For example, smartphone brands such as Xiaomi, OPPO and Vivo led the industry by releasing fast chargers in 2018, subsequently gaining consumer acceptance via their fast chargers’ competitive advantages in cooling efficiency and compact physical dimensions. Now, notebook computer manufacturers are also expressing a willingness to adopt fast-charging technology. The GaN power device market segment hence became the fastest-growing category in the ‘third-generation’ semiconductor industry, i.e. gallium nitride (GaN) and silicon carbide (SiC). TrendForce expects annual GaN power device revenue to rise by 73% year-on-year in 2021 to $83m.

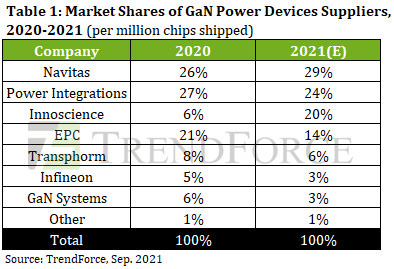

Regarding the ranking of GaN power device suppliers, Navitas is projected to achieve 29% market share (by total shipments) and overtake Power Integration for top place this year. Due to Navitas’ proprietary GaNFast power IC design and relationships with its partners in the semiconductor supply chain, it has become the largest supplier of GaN power IC chips in the consumer electronics markets. The firm is currently partnering with leading global smartphone and PC OEMs including Dell, Lenovo, LG, Xiaomi and OPPO. Given the rising demand for Navitas’ fast-charge ICs from clients this year, the company is expected to transition its chip orders in second-half 2021 from TSMC’s Fab 2, which is a 6-inch wafer fab, to other 8-inch fabs instead, in order to resolve the issue of insufficient production capacity. At the same time, Navitas is also targeting SAIC (Xiamen Sanan) as a potential supplier of foundry services. With regard to other markets for GaN, Navitas will likely target the data-center sector first by releasing related products in 2022.

Proven power management IC supplier PI (Power Integrations) was the longtime undisputed leader in the GaN power device market. For this year, PI has released the latest InnoSwitch4-CZ series of chips, based on its proprietary PowiGaN technology. Featured in products such as Anker’s 65W fast chargers, the InnoSwitch4-CZ chips have received universal acclaim from the fast-charge market, says TrendForce. In addition, PI’s recently released integrated AC-DC controller and USB PD controller ICs are expected to be major drivers of PI’s revenue growth this year. With an estimated market share of 24%, PI will likely take the runner-up spot in the ranking of GaN power device suppliers for 2021.

Innoscience to take third place in 2021 due to increased support from Chinese government

The market share of China-based Innoscience is projected to rise to 20% this year, the third highest among GaN suppliers, notes TrendForce. Innoscience’s remarkable performance can be attributed primarily to the massive spike in its shipment of high-voltage and low-voltage GaN products. In particular, Innoscience’s GaN power ICs (used for fast chargers) are now entering the supply chains of tier-one notebook manufacturers for the first time. At the same time, while the company’s Suzhou-based 8-inch wafer fab has already begun mass production, Innoscience will gradually expand the competitive advantage derived from its IDM business model in the fast-evolving GaN industry, reckons TrendForce. Not only is the firm currently actively cultivating its presence in applications including light detection & ranging (LiDAR), onboard chargers (OBCs) for electric vehicles (EVs), and LED power supplies, but it will also look to increase its market share even further next year via its diverse product mix.

Incidentally, the Chinese government has been increasing its support of the domestic third-generation semiconductor industry, while the ongoing China-US trade war has also forced Huawei and other companies in the downstream supply chain to reassess potential supply chain risks. Taken together, these factors have now created the perfect opportunity for China’s third-generation semiconductor material and component suppliers in both qualification/validation and production of domestic substitutes, further propelling the growth of the third-generation semiconductor industry in China. According to TrendForce, China invested in about 25 projects aimed at expanding the domestic production capacity of third-generation semiconductors in 2020 (excluding GaN-based optoelectronics materials and devices). These projects totaled more than RMB¥70bn, a 180% year-on-year increase.

In particular, commercial products manufactured using silicon carbide (SiC) substrates (the most crucial materials in the third-generation semiconductor industry chain) are primarily based on 4-inch wafers in China, but the country is currently migrating to 6-inch wafers. Although the technological gap between China and its global competitors is fast narrowing, China is still noticeably inferior in terms of monocrystalline quality, resulting in a relatively low self-sufficiency rate of high-performance SiC substrates. TrendForce’s data indicate that, as of first-half 2021, about seven production lines have been installed in China for GaN-on-silicon wafers, while at least four production lines for GaN power devices are currently under construction in China. On the other hand, China has at least 14 production lines (including those allocated to pilot runs) for 6-inch SiC wafers, notes TrendForce.