News: Markets

13 October 2021

Epitaxy equipment market growing at 8% CAGR to $1.1bn in 2026

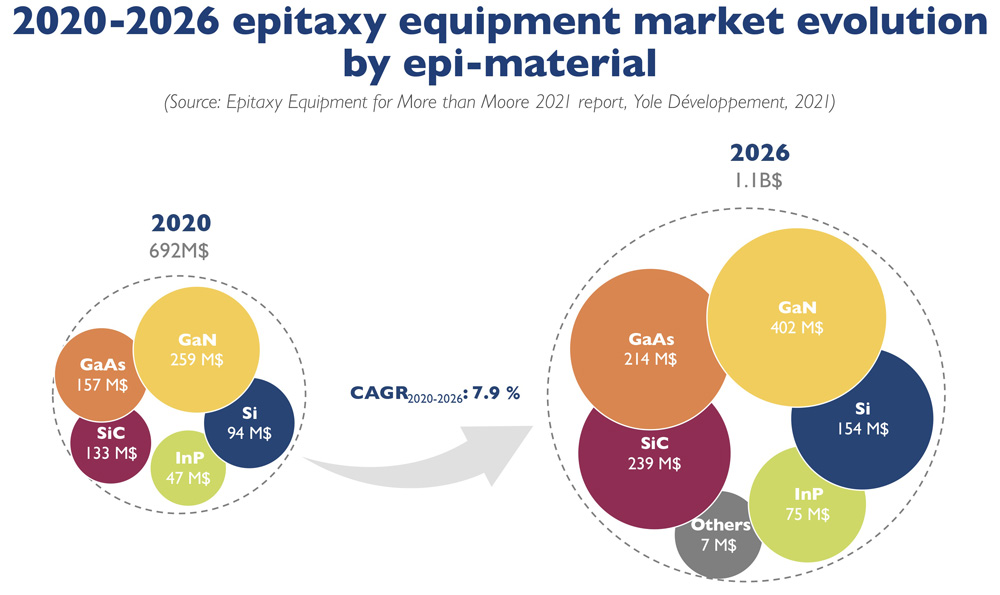

The epitaxy equipment market – including metal-organic chemical vapor deposition (MOCVD), high-temperature chemical vapor deposition (HTCVD) and molecular beam epitaxy (MBE) – was $692m in 2020 and is expected to rise at a compound annual growth rate (CAGR) of 8% to nearly $1.1bn in 2026, estimates market research and strategy consulting company Yole Développement in its report ‘Epitaxy Equipment for More than Moore’.

The MOCVD segment comprised over 60% of equipment market revenue in 2020, and is growing at a CAGR of 7% from 2020 to $630m in 2026. The HTCVD segment is growing at a CAGR of 9.5%, and will reach about $393m in 2026. The MBE segment is growing at a CAGR of 7.1%, and will be $68m in 2026.

However, these figures do not do justice to the vitality and omnipresence of the epitaxy step in mission-critical applications in market segments such as automotive electric vehicles/hybrid electric vehicles (EVs/HEVs), consumer (smartphone, smartwatch, augmented reality/virtual reality AR/VR), and aerospace & defense.

“We are at a crucial period of history where each device around us is becoming smarter, greener, and more compact.” says Vishnu Kumaresan PhD, technology & market analyst, Semiconductor Manufacturing at Yole. “Even the excruciating COVID-19 situation has had nothing more than a positive impact on the semiconductor industry by only further accelerating technological innovation. In such an innovation race to add more functionalities into our everyday devices using the More-than-Moore approach, the PPAC [power-performance-area-cost] factor is improved not only by scaling but also by using non-silicon materials and by heterogeneously integrating them to one another,” he adds.

In this regard, the silicon market segment – along with other market segments including non-classical substrates such as gallium arsenide (GaAs), gallium nitride (GaN), silicon carbide (SiC) and indium phosphide (InP) – is growing at significant CAGRs. However, the choice of these materials comes with stringent material quality requirements and hence necessitates ultra-pure thin films grown using epitaxy equipment.

The choice of equipment type depends on various factors such as layer quality, growth speed, cost of ownership (COO) and the material systems that can be grown. Whereas MOCVD and MBE is mainly used for compound semiconductor materials such as GaAs, GaN and InP, HTCVD technology is dedicated to silicon and SiC-based device manufacturing. The HTCVD SiC market segment is mainly dominated by Japan’s Tokyo Electron Ltd (TEL) and, in parallel, the HTCVD silicon epitaxy equipment market is dominated by US-based equipment maker Applied Materials.

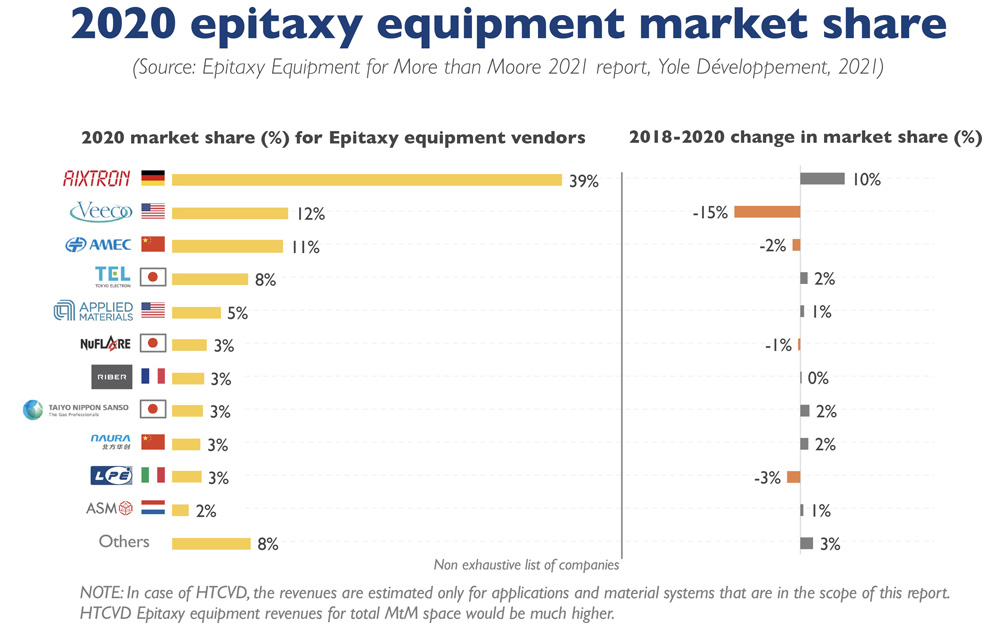

The high demand for equipment is only satisfied by very few equipment vendors currently. In total, Yole identifies about 11 major epitaxy equipment vendors in the More-than-Moore space. The top three – Germany’s Aixtron, the USA’s Veeco and China’s AMEC – clearly dominated the market in 2020, with 62% market share by revenue. However, this market is more complex. Indeed, it is also occupied by various other front-end equipment giants. Yole identifies Applied Materials, Tokyo Electron Ltd (TEL), ASM International and Naura for example; some domain-specific players such as Taiyo Nippon Sanso, NuFlare, LPE; and also some unidentified start-ups from China.

“The dominance by the top three players in 2020 was not a big surprise… it has remained the case at least since 2018,” says Kumaresan. “However, if we look at the top two players, between 2018 and 2020, the German equipment company Aixtron increased its market share by 10%, while Veeco has seen its market share fall by 15%. One of the many reasons for this is the US-China trade tension, which has chosen the semiconductor industry as one of their battlegrounds. This battle is even more pronounced in the epitaxy equipment space, as the demand is primarily driven by China. As a result, 2020 resulted in one of the best sales years in China for Aixtron, with approximately 57% of their revenue coming from the region, in contrast to Veeco’s mere 13% revenue.”

Aixtron hence continues to be the leader in the overall epitaxy equipment market. However, Veeco remains in second place, due to its improved MBE revenue in 2020 (although in MBE in particular, France-based Riber continues to be the market leader).

In parallel, AMEC follows closely in third place, with a good volume of equipment shipped for LED devices.

With the geopolitical situation evolving and the supply chain ever more fragile, Yole expects the competition between equipment vendors to intensify in the coming years.

www.i-micronews.com/products/epitaxy-equipment-for-more-than-moore-2021